The rise of the gig economy has transformed the way people work, offering flexibility, autonomy, and alternative income sources. However, for gig workers, retirement planning poses unique challenges compared to traditional employees with access to employer-sponsored retirement plans. In this article, we will explore the challenges faced by gig workers in retirement planning and discuss potential solutions to help them achieve financial security in retirement.

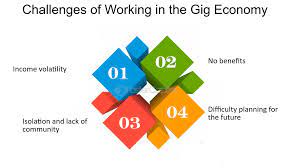

Challenges Faced by Gig Workers:

- Lack of Employer-Sponsored Retirement Benefits: Gig workers typically do not have access to employer-sponsored retirement plans, such as 401(k) or pension plans, which provide automatic enrollment, employer contributions, and tax advantages for retirement savings. Without employer-sponsored plans, gig workers must take the initiative to save and invest for retirement independently.

- Inconsistent Income and Cash Flow: Gig workers often experience fluctuating income and cash flow due to the variable nature of gig work, seasonal demand, and market conditions. Inconsistent earnings make it challenging to save and plan for retirement, as gig workers may struggle to cover living expenses, debt payments, and emergency savings while saving for retirement.

- Lack of Financial Stability and Benefits: Gig workers may lack financial stability and benefits, such as health insurance, disability insurance, and unemployment benefits, which are typically provided by employers to traditional employees. Without financial stability and benefits, gig workers face greater financial risks and vulnerabilities, including inadequate healthcare coverage and income loss due to illness or injury.

- Limited Access to Retirement Savings Vehicles: Gig workers have limited access to retirement savings vehicles compared to traditional employees, as they may not qualify for employer-sponsored plans or lack the resources to open and contribute to individual retirement accounts (IRAs) or other retirement savings accounts. Limited access to retirement savings vehicles hinders gig workers’ ability to save and invest for retirement effectively.

Solutions for Retirement Planning in the Gig Economy:

- Establish a Retirement Savings Plan: Gig workers should prioritize retirement savings by establishing a retirement savings plan and setting aside a portion of their income for retirement. Set specific savings goals, automate contributions to retirement accounts, and track progress towards retirement goals to build a retirement nest egg over time.

- Explore Self-Employed Retirement Plans: Gig workers can explore self-employed retirement plans, such as Simplified Employee Pension (SEP) IRAs, Solo 401(k) plans, or individual 401(k) plans, which offer tax advantages and higher contribution limits compared to traditional IRAs. Self-employed retirement plans allow gig workers to save and invest for retirement while reducing taxable income.

- Diversify Income Streams: Gig workers can diversify their income streams to create multiple sources of revenue and increase financial stability. Explore opportunities for gig work in different industries or platforms, develop marketable skills and expertise, and leverage technology to expand income-generating opportunities and mitigate income volatility.

- Invest in Skill Development and Education: Invest in skill development, education, and training to enhance employability, income potential, and long-term career prospects in the gig economy. Acquire in-demand skills, certifications, and qualifications to increase earning opportunities, command higher rates, and build a sustainable income stream for retirement planning.

- Prioritize Financial Wellness: Prioritize financial wellness by managing debt, building emergency savings, and protecting against financial risks, such as disability, illness, and unemployment. Develop a comprehensive financial plan that addresses short-term financial needs, long-term retirement goals, and risk management strategies to achieve financial security and peace of mind in retirement.

Retirement planning in the gig economy presents unique challenges and considerations for gig workers compared to traditional employees. By acknowledging the challenges and proactively addressing them with strategic solutions and proactive measures, gig workers can overcome obstacles, build financial resilience, and achieve retirement security. By establishing a retirement savings plan, exploring self-employed retirement plans, diversifying income streams, investing in skill development, and prioritizing financial wellness, gig workers can navigate the complexities of the gig economy and create a secure and fulfilling retirement future.