Building a diversified investment portfolio is essential for long-term financial success and wealth accumulation. A well-diversified portfolio helps mitigate risk by spreading investments across different asset classes, industries, and geographic regions. In this article, we will discuss the principles of portfolio diversification and provide practical tips for constructing a diversified investment portfolio that promotes long-term growth and stability.

Understanding Portfolio Diversification:

Portfolio diversification is the practice of spreading investments across a variety of asset classes to reduce exposure to any single asset or risk factor. By investing in assets with different risk-return profiles, correlations, and market dynamics, investors can achieve a more stable and resilient portfolio that can weather fluctuations in the market.

Key Principles of Portfolio Diversification:

- Asset Allocation: Asset allocation is the process of dividing your investment capital among different asset classes, such as stocks, bonds, real estate, and commodities. The optimal asset allocation depends on your investment goals, risk tolerance, and time horizon. Generally, younger investors with a longer time horizon may have a higher allocation to equities, while older investors may allocate more to fixed-income securities for capital preservation.

- Diversification Across Asset Classes: A well-diversified portfolio should include a mix of asset classes with low correlation to each other. For example, equities tend to have a low correlation with bonds, providing diversification benefits. Consider allocating your investment capital across a diverse range of asset classes to spread risk and capture opportunities in different market environments.

- Diversification Within Asset Classes: Within each asset class, diversification can further reduce risk and enhance returns. For example, within the equity asset class, you can diversify across different sectors, industries, and geographic regions. Similarly, within the bond asset class, you can diversify across different credit qualities, maturities, and issuers.

- Rebalancing: Rebalancing is the process of periodically adjusting your portfolio back to its target asset allocation. As asset classes perform differently over time, your portfolio may drift from its original allocation. Rebalancing ensures that your portfolio remains aligned with your investment objectives and risk tolerance.

Practical Tips for Building a Diversified Investment Portfolio:

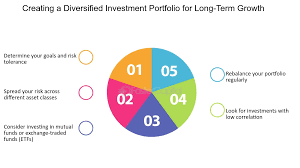

- Define Your Investment Goals: Start by defining your investment goals, including your target rate of return, time horizon, and risk tolerance. Your investment goals will guide your asset allocation decisions and portfolio construction.

- Conduct a Risk Assessment: Assess your risk tolerance and capacity for risk to determine the appropriate mix of assets for your portfolio. Consider factors such as your investment timeframe, financial obligations, and emotional temperament when evaluating risk.

- Choose a Diversified Asset Allocation: Select a diversified asset allocation that aligns with your investment goals and risk tolerance. Consider allocating your investment capital across a mix of equities, fixed income, real estate, and alternative investments to achieve diversification.

- Invest in Low-Cost Index Funds and ETFs: Consider investing in low-cost index funds and exchange-traded funds (ETFs) to gain exposure to a broad range of asset classes and market segments. Index funds and ETFs offer diversification benefits, low fees, and passive management, making them suitable core holdings for a diversified portfolio.

- Monitor and Rebalance Your Portfolio: Regularly monitor your portfolio’s performance and asset allocation to ensure it remains aligned with your investment objectives. Rebalance your portfolio periodically to realign your asset allocation and maintain diversification.

Building a diversified investment portfolio is essential for achieving long-term growth and financial security. By following the principles of portfolio diversification and implementing practical tips for constructing a well-diversified portfolio, investors can reduce risk, enhance returns, and achieve their investment goals over time. Remember to define your investment goals, assess your risk tolerance, choose a diversified asset allocation, invest in low-cost index funds and ETFs, and regularly monitor and rebalance your portfolio to optimize performance and achieve long-term growth. With a disciplined approach to portfolio construction and management, investors can navigate market fluctuations and build wealth over time.