Budgeting is the cornerstone of financial success, providing individuals with a roadmap to manage their income, expenses, and savings effectively. By creating and following a budget, individuals can take control of their finances, achieve their financial goals, and ultimately attain financial freedom. In this guide, we will explore the principles of budgeting, practical tips for creating and sticking to a budget, and strategies for achieving long-term financial freedom.

Understanding Budgeting:

Budgeting is the process of planning and tracking income and expenses to ensure that spending aligns with financial goals and priorities. A budget helps individuals allocate their financial resources wisely, identify areas for saving and investment, and avoid overspending or debt accumulation.

Principles of Budgeting:

- Setting Financial Goals: Establish clear and achievable financial goals, such as saving for retirement, paying off debt, or building an emergency fund. Define specific objectives, timelines, and action plans to guide your budgeting efforts and track progress towards your goals.

- Tracking Income and Expenses: Track all sources of income and expenses to understand your cash flow and identify opportunities for saving and spending optimization. Use tools such as spreadsheets, budgeting apps, or online banking platforms to categorize expenses and monitor spending patterns over time.

- Differentiating Needs vs. Wants: Distinguish between essential needs, such as housing, food, and healthcare, and discretionary wants, such as entertainment, dining out, and luxury items. Prioritize spending on needs while allocating discretionary income towards savings and financial goals.

- Creating a Realistic Budget: Develop a realistic budget that reflects your income, expenses, and financial priorities. Allocate funds to essential expenses first, such as housing, utilities, transportation, and debt payments, before allocating discretionary income to wants and savings goals.

Practical Tips for Budgeting:

- Track Spending: Monitor your spending habits regularly to identify areas for saving and optimization. Keep receipts, use expense tracking apps, or review bank statements to track all purchases and categorize expenses according to budget categories.

- Establish Budget Categories: Organize expenses into categories, such as housing, transportation, groceries, utilities, entertainment, and savings. Allocate a portion of income to each category based on priority and necessity, adjusting as needed to accommodate changes in income or expenses.

- Set Spending Limits: Establish spending limits for discretionary categories to prevent overspending and stay within budgetary constraints. Use cash envelopes, debit cards, or budgeting apps to track spending in real-time and avoid impulse purchases.

- Automate Savings: Set up automatic transfers or contributions to savings and investment accounts to ensure consistent saving and investment habits. Pay yourself first by allocating a portion of income towards savings before covering discretionary expenses.

Strategies for Achieving Financial Freedom:

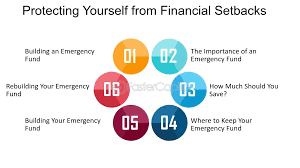

- Build an Emergency Fund: Save at least three to six months’ worth of living expenses in an emergency fund to cover unexpected expenses or financial setbacks. Keep emergency savings in a liquid, accessible account, such as a high-yield savings account or money market fund.

- Pay Off Debt: Prioritize debt repayment to eliminate high-interest debt and free up cash flow for saving and investing. Use debt repayment strategies such as the debt snowball or debt avalanche method to accelerate debt payoff and reduce interest costs.

- Save for Retirement: Contribute to retirement accounts, such as 401(k) plans, IRAs, or pension schemes, to build long-term wealth and secure financial independence in retirement. Take advantage of employer matching contributions and tax-advantaged retirement savings options to maximize retirement savings potential.

- Invest for Growth: Invest surplus funds in diversified investment portfolios, including stocks, bonds, mutual funds, ETFs, and real estate, to achieve long-term growth and wealth accumulation. Consider working with a financial advisor or investment professional to develop a personalized investment strategy aligned with your risk tolerance and financial goals.

Budgeting is a fundamental tool for achieving financial freedom and security, providing individuals with a framework to manage income, expenses, and savings effectively. By understanding the principles of budgeting, tracking spending habits, and prioritizing financial goals, individuals can take control of their finances, eliminate debt, and build wealth over time. Whether saving for emergencies, retirement, or other financial objectives, the art of budgeting empowers individuals to make informed financial decisions, live within their means, and achieve long-term financial success. By mastering the art of budgeting and implementing sound financial strategies, individuals can embark on a journey towards financial freedom and live life on their own terms.